WORLD-GENERATION MAY/JUNE 2015 V.27 #2

29

PERSPECTIVE

more of system capacity) in 2020, both

being considerably higher than system

operators would want to experience, and 43

such overloads for the year as a whole. We

found that the MISO region would need at

least $500 to $750 million in transmission

investments in order to address transmis-

sion security issues from the implementa-

tion of the proposed CPP, not including

transmission projects that have already

been approved.

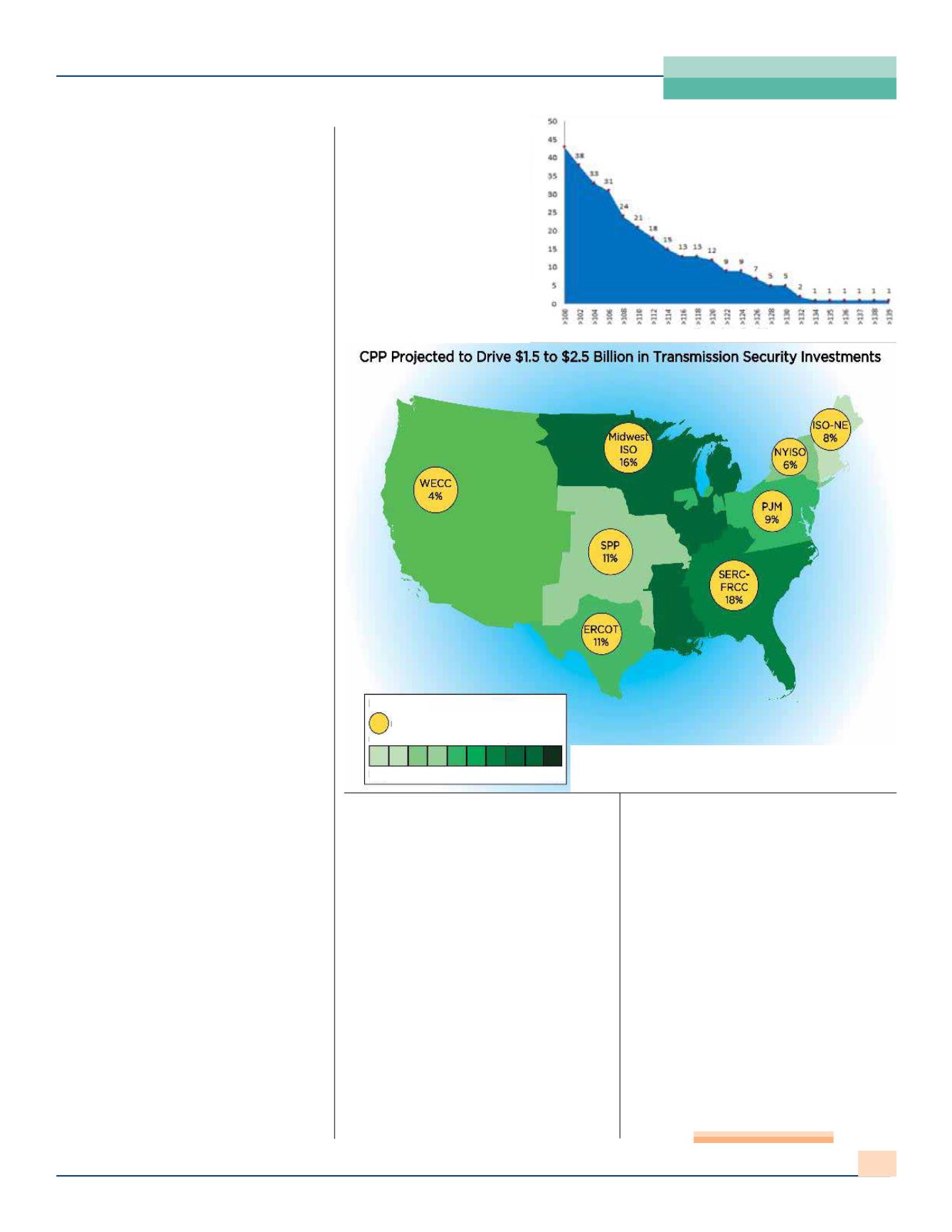

To develop a nationwide estimate of the

investment needs, we then extrapolated our

MISO findings by assuming that the aver-

age impact of a generator retirement on

transmission security is similar in other

regions. For just this one function, we found

that the CPP would precipitate the need for

$1.5 to $2.5 billion nationwide in additional

investment by 2020. Figure 6 is a color con-

tour showing the nationwide investments by

region. Clearly some regions will be more

affected than others. Darker shades repre-

sent larger investments.

Since we used single (N-1) contingency

analysis, we believe that this estimate is

conservative because system planners will

analyze contingencies more severe than

those included in our assessment. In addi-

tion, this analysis did not include the incre-

mental investment required by 2020 for two

other primary grid functions: 1) resource

adequacy (maintaining sufficient capacity

to meet customer needs in spite of sched-

uled and unscheduled outages); and 2)

transmission adequacy (having sufficient

transmission capacity to move power across

key interfaces in the system). We further

did not include transmission required to

interconnect new generation that CPP-

stimulated retirements would bring forward

in time.

How much could these investments be?

They could be considerable. Transmission

security generally requires less investment

than either of the other grid functions men-

tioned, and the need for interconnection

(particularly of renewables) and the use of

N-1-1 criteria will increase the investment

required. Thus, we expect that the incre-

Figure 5 – Without

Investment there would be

Many Transmission Security

Thermal Overloads

Figure 6 – The Need for Transmission Investment is

Widespread due to the CPP

mental transmission investment could be

quite a few multiples of the amount

required for transmission security. ICF

can evaluate those requirements based on

assessments of the CPP in specific cases

to help companies identify such needs and

opportunities.

Could these needs be satisfied?

Absolutely. An incremental $1.5 to $2.5 bil-

lion investment stemming from transmis-

sion security spread over several years rep-

resents a small fraction of the national

5-year capital expenditure on transmission

— less than 3% — and will not be an

impediment to CPP implementation. The

challenge is not making the investments

needed, but rather the time frame in which

they would need to be carried out. High-

voltage transmission investment from start

to finish can easily take 10 years, and that

does not count the time required for the

solicitation processes described above. It

may be quite challenging (some would say

infeasible) for transmission owners to

make the investment required in the time

frame required to avoid the kind of system

violations described above, which could put

the reliability of power supply at risk.

Thus, it’s not a question of “how much?”,

but rather, “how soon?”.

ICF is regularly evaluating such sce-

narios and continues to work with clients

to analyze the specifics of each region and

the magnitude of such requirements.

WHO GETSTO BUILDTRANSMISSION?

CONTINUED FROM PAGE 28

Legend

Retiring Capacity as % of Peak Demand

Investment Needed to Resolve Reliability Violations

Low--------------------------------------------High

MISO Incremental Transmission Line Overloads

under Proposed CPP

Thermal Loading (%)

# of Transmission Lines Overloaded