CLASS OF 2016

WORLD-GENERATION FEBRUARY/MARCH 2016

20

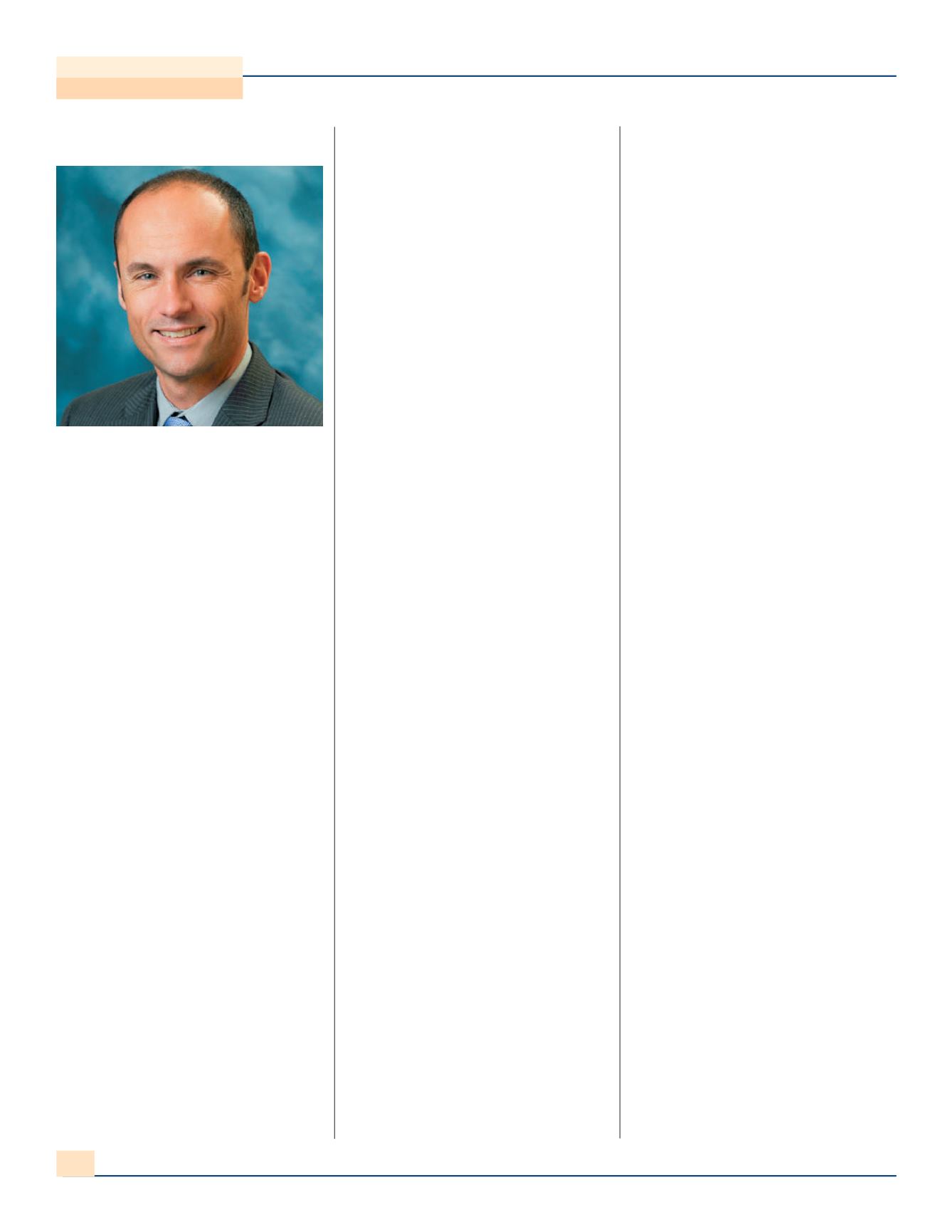

Tristan Grimbert, CEO of EDF

Renewable Energy, the North American

Renewable arm of Electricité de France,

participated in a panel discussion covering

market trends at the annual REFF Wall

Street conference hosted by Euromoney

and ACORE.

WHAT IS DIFFERENT ABOUTTHE RENEW-

ABLE MARKETTODAYTHANTWO YEARS

AGO?

Tristan Grimbert:

First, there is a lot

more money looking to move into renew-

able energy. It is not only yield cos. There

is an imbalance between the amount of

money and the number of projects available

for investment.

Second, our business is becoming

more and more technical. Being able to

deliver on the business plan requires more

and more technical knowledge and resourc-

es. I am thinking in particular about turbine

performance, congestion risk and basis

risk. As there is more penetration of renew-

ables, the ability to understand and act on

business risk and market conditions is

becoming critical.

The third thing that is different is we

have reached a turning point in the last

year in the US where we can talk again

about carbon pricing and about moving

away from subsidies to something that

would recognize the cost of carbon. My

hope is that, within the next five years, we

will move away from renewable portfolio

standards and all the subsidies to a truly

market-based mechanism for carbon pric-

ing. That is my hope.

WHAT ARE YOUR GREATEST CHALLENGES

TODAY?

Tristan Grimbert

: Defining a viable

business model in the distributed space is a

challenge with the lack of differentiation

and the repetitiveness and credit issues. A

lot of people are moving into that sector. It

is very difficult to figure out how to make

money. That is one area with which we are

struggling.

Another challenge is finding the right

balance for spending on the development

pipeline in relation to the size of the market

when the tax incentives are always on the

verge of expiring. Five years ago, there

were too many projects under development.

I think the wind pipeline was something

like 351 gigawatts for an annual market of

six to eight gigawatts, so it was 50 years of

projects. Today, the number has been

reduced significantly.

Lastly, it is a challenge to forecast the

price and cost curves accurately. We must

take a view on the future price for electrici-

ty and the future cost of solar and wind

equipment and the future cost of capital.

We have been talking about yield cos and

their impact on the cost of capital the last

couple of years, but at some point the cost

of capital will start going back up. You do

not want to be caught in a trap where you

have offered an aggressive electricity price

to win a power purchase agreement and

then the cost of capital goes back up. On

the equipment side, we expect the costs to

keep falling , but the question is to what

extent.

SOMETHING LIKE 38% OF US ELECTRICITY

SUPPLY IS FROM COAL. CONSULTANTS

EXPECT ATHIRD OF THATTO BE RETIRED

BETWEEN 2017 AND 2020, BUTTHERE IS A

DEBATE ABOUT WHETHERTHAT CREATES A

LOT OF OPPORTUNITYTO REPLACE THAT

CAPACITY. DO YOUTHINKTHIS IS A GREAT

OPPORTUNITY?

Tristan Grimbert

: The coal retire-

ments will allow us to keep a market in the

range of five to 10 gigawatts of new wind

capacity additions a year, and that is critical.

You do not need a lot of storage to allow

much more penetration of wind and solar.

The coal retirements driven by the Clean

Power Plan will allow the utility-scale wind

and solar markets to continue adding capac-

ity over the next 15 years at the current

level. It was suggested earlier that the

growth rate is accelerating. I do not think

we have an acceleration of the growth rate,

but I think we will have stable growth.

LET’S PROBE ON STORAGE. MANY PEOPLE

SAYTHE WIDESPREAD ADOPTION OF BAT-

TERIES WILL LEADTO A FUNDAMENTAL

CHANGE INTHIS MARKET. DO YOU AGREE?

Tristan Grimbert:

We are building a

20-megawatt battery storage project right

now in PJM, and we have more in develop-

ment. PJM does not need a lot of storage in

order to be able to manage the intermittent

generation on the grid, so that market

reached saturation quickly. The potential

storage market is about a tenth of the wind

capacity: rough calculation, back of the

envelope, you need an order of magnitude

less capacity in storage than you need in

intermittency.

Keep in mind that storage is

a transmission asset. The more reliable and

the more structured the grid, the less you

need storage.

So, yes, storage is a market

for us, and we are in it, but it is a fraction of

the solar or wind potential market in terms

of capital deployment.

Storage is a diverse universe. We can

talk about a battery bought by a residential

customer all the way to a pumped storage

hydroelectric project or thermal storage

facility for a city that is huge in scale. I

think it will be all of the above. You need to

manage the grid in a way that you can pro-

vide some load-shifting equipment or load-

following equipment.

The question about battery storage is

the timing. The timing depends on the tran-

sition to distributed generation. Battery

storage at the residential or commercial

TRISTAN GRIMBERT

President and CEO

EDF Renewable Energy

(continued page 26)