CLASS OF 2016

WORLD-GENERATION FEBRUARY/MARCH 2016

24

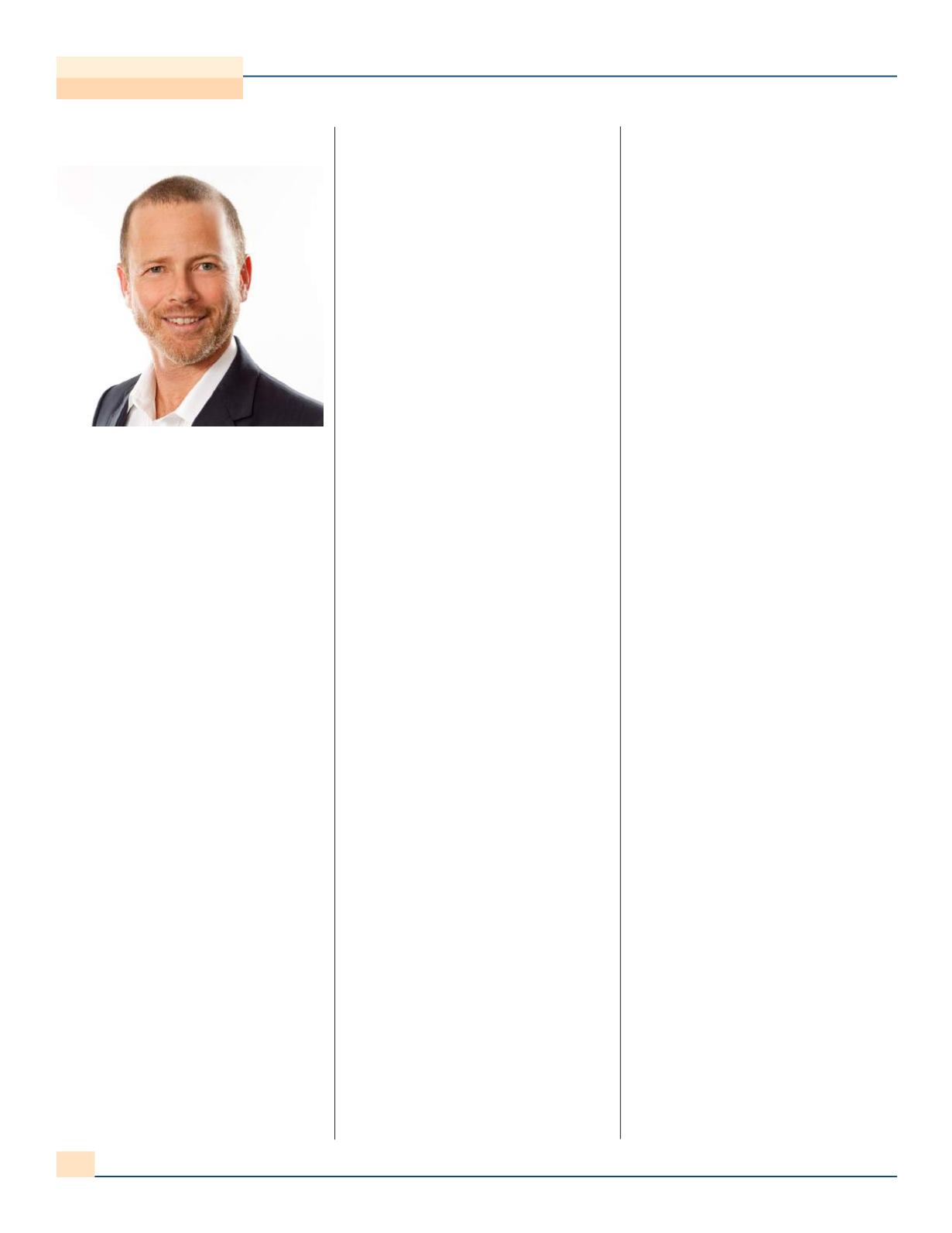

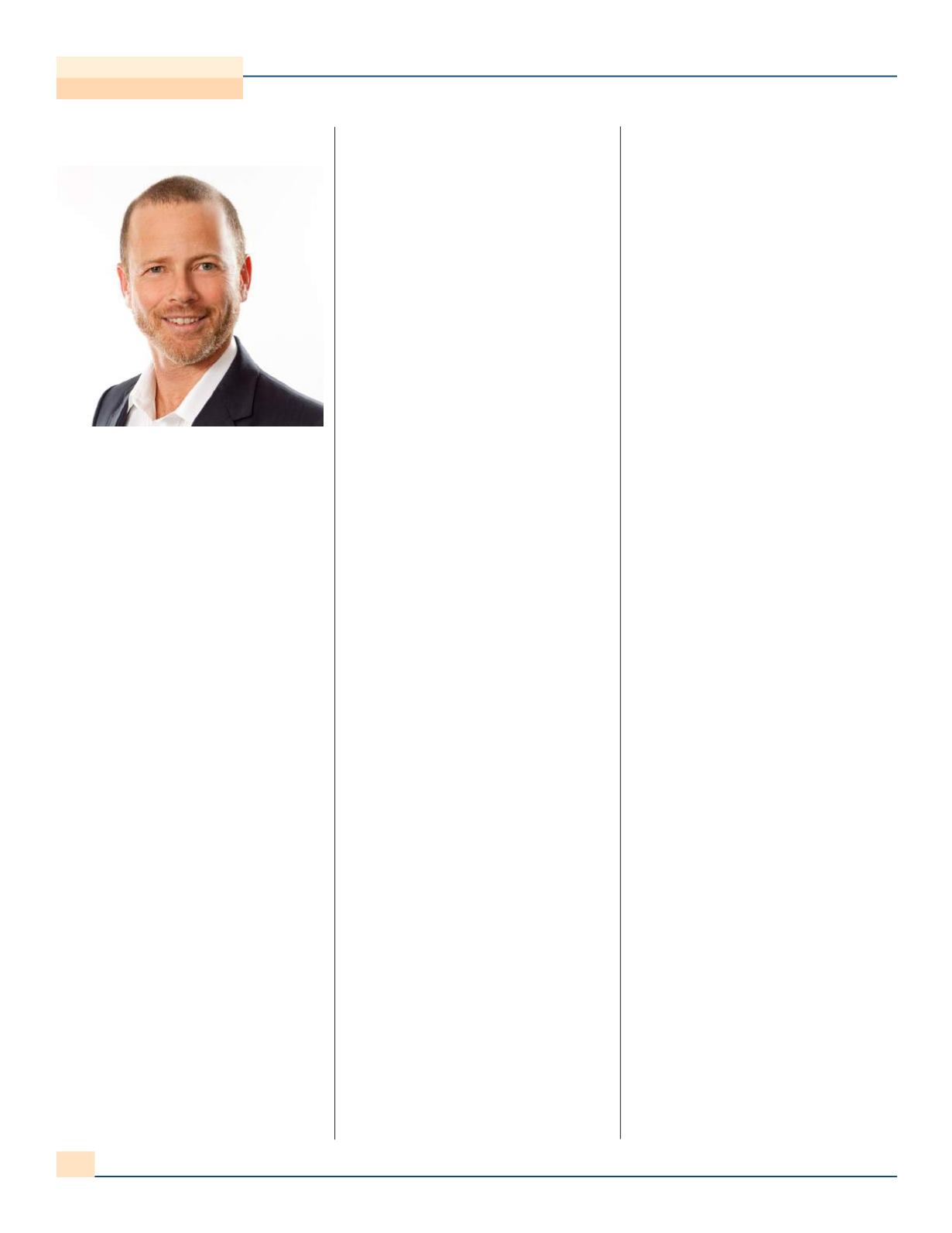

Andrew de Pass, CEO of Conergy

shares his perspectives on the renewable

energy market.

WHAT IS DIFFERENT ABOUTTHE RENEW-

ABLES MARKETTODAY COMPARED WITH

TWO YEARS AGO?

Andrew de Pass:

I come at this from

the perspective of a solar company. Two

years ago, oil prices were higher, so it was

not as difficult to make competitive bids to

supply electricity in certain countries. Of

course today we also have the whole yield co

craze whereby long-duration cash flows are

in vogue. This has the potential, with the

launch of vehicles like the SunEdison yield

co aimed at emerging markets, to give devel-

opers like Conergy more transparency and

visibility on take-out pricing in those markets.

So one change is the fossil fuel pricing and a

second is the attractiveness of the long-dura-

tion cash flows in the capital markets.

IS ACCESSTO CAPITAL NO LONGER AN

ISSUE FORTHIS INDUSTRY?

Andrew de Pass:

The cost of capital

and availability vary at different stages from

early-stage development, mid- to late-stage

development, during the construction cycle

from notice to proceed to the commercial

operation date, and then for operating

assets. The market for operating assets is

extremely competitive, and there is price

visibility and good availability of capital. In

certain markets, construction finance

remains a challenge. For example, as we

look to finance projects in new markets like

Turkey or Mexico or Southeast Asia, con-

struction finance is more challenging and

expensive. In the US, it is available for prop-

erly structured projects.

Late-stage development capital is avail-

able and the returns have definitely been

pushed down. For example, in the UK

where we developed, constructed and oper-

ate more than 200 megawatts in the last 12

months, we were buying later-stage devel-

opment rights for a cash-on-cash return of

1.25 to 1.5 times investment, and that has

now been pushed down to 1.1 times.

The returns are still very attractive in

early-stage projects where the dollars per

megawatt to develop are low in solar,

$25,000 to $50,000 maximum, and the

returns can be multiples. But you have to

work with a portfolio because you can lose

money in any one project. The point is it is

important to differentiate among stages of

development.

WHAT ARE YOUR GREATEST CHALLENGES

TODAY?

Andrew de Pass:

Conergy has a glob-

al footprint and so the challenges vary by

country. We operate in 15 countries. One of

our challenges in the developed markets is

they are moving away from utility-scale to

distributed generation including industrial

rooftop. We expect this trend to continue

over the next five years. Distributed gener-

ation is a different business than utility

scale because you have to acquire custom-

ers, you have challenges with credit assess-

ment, you have to scale up and the projects

are relatively small. The question is: How

are we going to make money consistently

in such markets?

We are too late in the US to tackle resi-

dential, but we are a leader in solar in many

other markets where residential is starting

to take hold, and the discussion amongst

senior management and the boards is: Do

we or don’t we do this? The projections say

that residential could be 30% of these mar-

kets and then you ask, “What is the busi-

ness, and how do we do it effectively?” It is

a customer acquisition business; it is not a

technology business. What can we learn

from the best practices in the US, and can

they apply in other markets? Some do, and

some don’t. So our challenge is, in addition

to the complexity of managing a global

solar downstream company, how do we

make money consistently in distributed

generation specifically with rooftop?

WHICH COUNTRIES ARE YOUTRYINGTO

MOVE TO DISTRIBUTED?

Andrew de Pass:

In the US, we are

focused on small-scale utility as well as com-

mercial rooftop. We think in the US market

you have to have financial innovation, so we

recently closed on the first commercial PACE

deal with tax equity with the project owned

by Conergy. In the UK, we launched a com-

mercial industrial product. In Germany, we

have rooftop partnerships with utilities like

RWE and local residential players.

We are focused on batteries. Conergy

has an R&D lab focused on storage in our

headquarters in Hamburg because we think

it is critical to integrate storage into our sys-

tem offering in the medium term. Our R&D

specialists in storage used to think it would

take four or five more years to become eco-

nomical; we see the trend accelerating to a

point where we now expect batteries with a

couple hours of storage to become economi-

cal in the next two years.

In Germany, solar kits are offered today

with storage. This makes sense in Germany

because there is no residential net metering.

We have pilot projects that are relatively

small for the use of lithium ion batteries for

small utility-scale solar projects.

DO YOUTHINK WE WILL SEE AN ABRUPT

SHIFT IN PUBLIC OPINION ON CARBON IN

THIS COUNTRY?

Andrew de Pass: I do. We have to

create a level playing field and simplify.

When you compare the US to other markets

from a regulatory and incentive standpoint,

this whole tax equity thing is a nightmare.

ITC and PTC: they are a nightmare for

developers and operators to understand.

ANDREW de PASS

CEO

Conergy

(continued page 25)